China a decade after the launch of the Belt and Road Initiative

Abstract: This case aims to create a discussion to assess whether China’s Belt and Road Initiative (BRI), launched in 2013, can still be a remedy for the country’s slowing economic growth. Despite its promises to deliver economic, social, and political benefits to China and BRI member countries, some challenges may hinder the implementation of this mega project. Students will discuss what the governments of China and BRI member countries should do to ensure smooth implementation of BRI projects, and what other initiatives China could undertake to improve its competitiveness and revitalize its slowing economic growth.

Keywords: Belt and Road Initiative, China, competitiveness, creating shared value

Authors:

Mei Yan-Koponen, corresponding author, former International Business student from Jamk University of Applied Sciences, School of Business, meikoponen (at) hotmail.com

Murat Akpinar, Jamk University of Applied Sciences, School of Business, Rajakatu 35, 40200, Jyväskylä, Finland

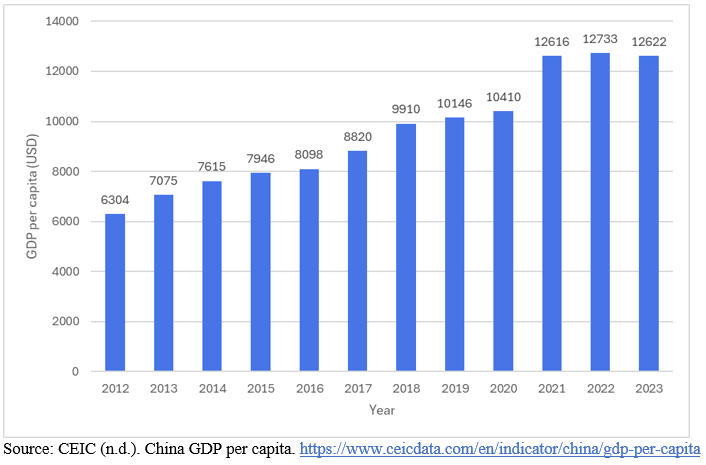

During the last 35 years, the People’s Republic of China (China hereafter) achieved an average annual gross domestic product (GDP) growth of 9%, and about 800 million people have lifted themselves above the poverty threshold [1]. With a nominal GDP of 4,167 billion USD [2], China has become the second-largest economy in the world after the United States. Despite this remarkable success, fears for a slowdown in growth have been growing (see Exhibit 1) following increasing trade tensions between the United States and China during the Presidency of Donald Trump (2017-2021), disruptions in global value chains after the COVID-19 pandemic, and increasing global uncertainties with the wars in Ukraine and the Middle East.

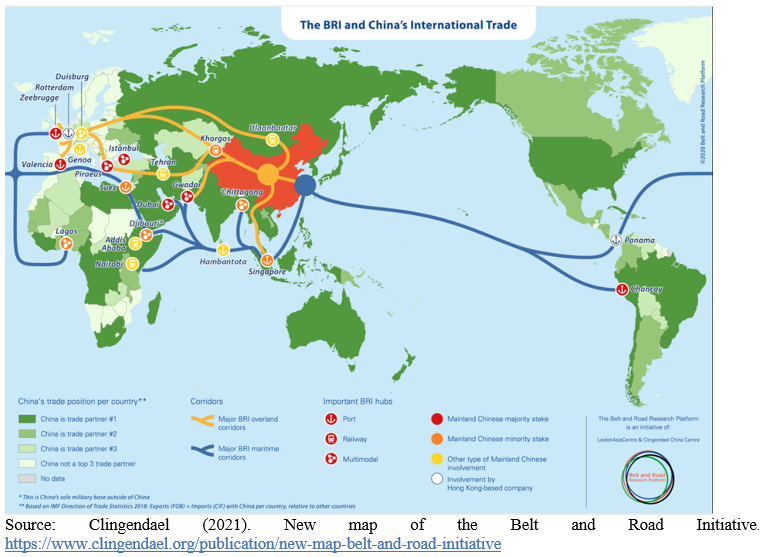

China needs initiatives to maintain its economic growth momentum. One mega project initiated by President Xi Jinping in 2013 for this purpose is the Belt and Road Initiative (BRI hereafter). BRI aimed to build infrastructures to create new Silk Roads and network China by land and sea with countries across Asia, Europe, Africa, and Oceania (see Exhibit 2). This project aimed to foster trade and investments across the extended region and at the same time secure vital energy supplies, which are needed by China’s manufacturing industries. Already a decade since its launch, will BRI be able to deliver its promises and revitalize China’s slowing economic growth?

China’s economic development

After its establishment in 1949, China maintained a centrally planned economy until 1979. Under this regime, the state followed a policy of self-sufficiency and controlled the production, pricing, and allocation of resources, whereby state-owned enterprises (SOEs) manufactured 75% of industrial products, and the roles of the private sector and foreign investments were very limited [3]. During this period, with its Great Leap Forward policy (1958-1962) and the Great Proletarian Cultural Revolution (1966-1976), the communist government led by Mao Zedong introduced land reforms and industrialization policies to transform China from an agrarian to an industrial economy [4].

China’s economic policy shifted in 1979 under the leadership of Deng Xiaoping towards a more market-oriented economy. Initially, the reforms were focused on the agriculture sector and rural areas, allowing farmers to have price and ownership incentives and sell a portion of their crops on the free market [5]. This was followed by the introduction of trade liberalization and the establishment of special economic zones during 1980-1984 to promote exports, attract foreign investments, and import high-technology products [6]. The 1980s and 1990s saw significant industrialization, urbanization, and a restructuring of SOEs in China, resulting in GDP growth at an average annual rate of ca. 10% from 1978 to 2005 [7].

China joined the World Trade Organization in 2001, which marked a significant milestone in opening opportunities to access the global market and continue its high growth during the 2000s and 2010s driven by its export-oriented manufacturing industries [8]. China ranked as the world’s most competitive manufacturing location in the 2016 Global Manufacturing Competitiveness Index of Deloitte, surpassing the United States [9].

In addition, the government’s “Made in China 2025” policy has incentivized Chinese companies to transit from producing cheap low-tech products to developing higher value-added products [10]. Good examples of such transition are already observed in the telecommunications and automotive industries. In the telecommunications industry, Huawei has become the world’s largest manufacturer of telecommunications equipment, taking over Ericsson, and the largest manufacturer of smartphones, surpassing Apple and Samsung [11, 12]. In the automotive industry, China was not only the leading manufacturing location with 30.2 million vehicles (32.2% of global production) in 2023 [13], but manufacturers, like BYD and Geely, are today among the leaders in the transition to electric vehicles.

Next to its leadership in manufacturing industries, China is the world’s leading producer of cement, steel, and chemical fertilizers. It is also the world’s largest producer and consumer of agricultural products, employing about 300 million people [14]. In addition, the mining industry plays a key role in the country’s GDP. Home to the third largest coal reserves following the United States and Russia, China produces ca. 57% of its electricity from coal and ca. 20% from hydropower, while renewable energy sources are becoming the new frontier [15]. At the same time, China is dependent on imports of strategic resources such as crude oil, natural gas, and iron ore from a few countries, and the government is aiming to lessen its dependence by diversifying its base of supplier countries through BRI [16].

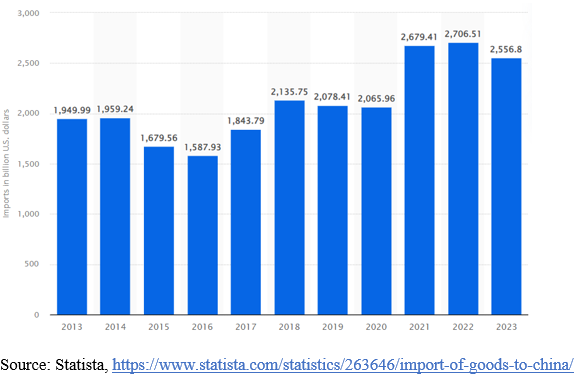

China’s exports have risen from 2,202 billion USD in 2013 to 3,380 USD in 2023 (compound annual growth rate of 4.4%), making China the largest exporter in the world (see Exhibit 3). China’s main export destinations in 2022 were the United States, the Association of Southeast Asian States, and the European Union, and its main export products were machinery such as computers, broadcasting technology, and telephones as well as transport equipment [17]. China’s imports have increased from 1,950 billion USD in 2013 to 2,557 USD in 2023 (compound annual growth rate of 2.7%), making it the second largest importer in the world after the United States (see Exhibit 4). In 2023, China’s main import items were integrated circuits, crude oil, iron ore, plastics in primary forms, and motor vehicles, and the Association of Southeast Asian States was the main region exporting to China, accounting for ca. 15% of China’s imports, followed by the European Union [18].

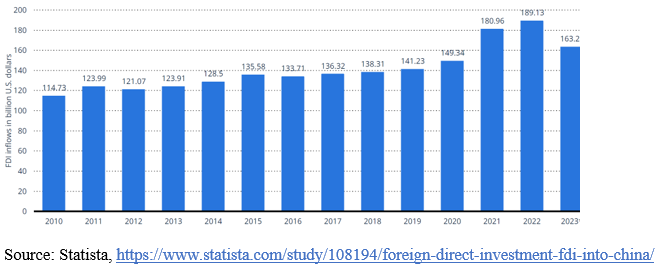

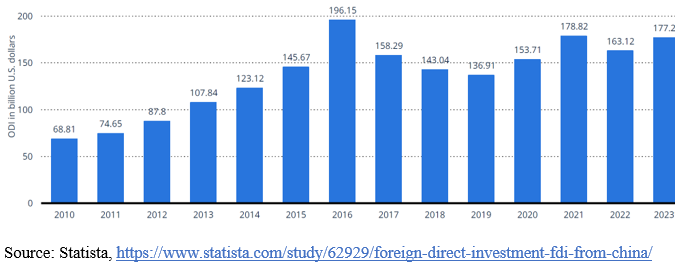

Following the United States, China was the second in the world in 2023 to attract foreign direct investments (FDI) of 163 billion USD [19]. Despite a decrease in 2023 from 189 billion USD in 2022, inward FDI has increased throughout the 2010s (see Exhibit 5). Outward FDI from China rose from 69 billion USD in 2010 to its peak value of 196 billion USD in 2016, but then it decreased to 137 billion USD in 2019 and never reached again its peak level in 2016 (see Exhibit 6).

The government has been the main actor in upgrading the innovation ecosystem and driving economic activity in China through its innovation-oriented strategy, expressed in the five-year plans and corresponding policies [20]. As part of this strategy, the government has funded companies, universities, and research institutes for their R&D projects, invested in innovation infrastructure, and reinforced the protection of intellectual property rights [21]. Thanks to these initiatives, China ranked 11th in the Global Innovation Index in 2024, and its 26 science and technology clusters ranked among the world’s top 100 science and technology clusters [22]. Among these, the Shenzhen-Hong Kong-Guangzhou cluster ranked 2nd, the Beijing cluster 3rd, the Shanghai-Suzhou cluster 5th, the Nanjing cluster 9th, and the Wuhan cluster 13th [23].

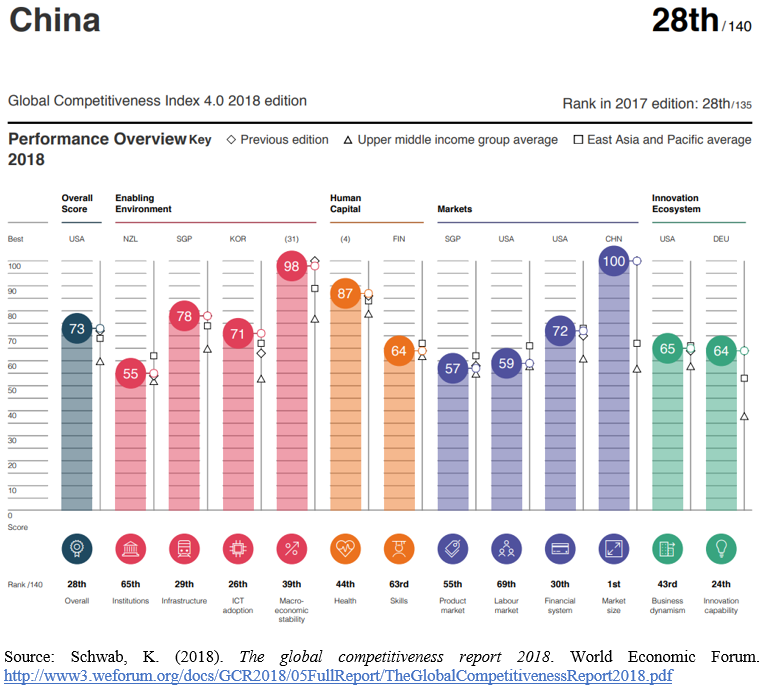

China ranked 28th out of 140 countries in the World Economic Forum’s global competitiveness index in 2018, ahead of the other BRICS economies Russia (43rd), India (58th), South Africa (67th), and Brazil (72nd) [24]. China’s main strength for competitiveness was its huge market size (1st): other relative strengths were in ICT adoption (26th) and infrastructure (29th) pillars, two remarkable achievements given the sheer size of the country (see Exhibit 7). On the less positive side, China’s labor market (69th), institutional framework (65th), skills (63rd), and product market (55th) needed further improvement (see Exhibit 7).

BRI

BRI, launched in 2013, was a foreign policy and economic development strategy using an enormous trade and infrastructure project that targeted to link China physically and financially to economies across Asia, Europe, Africa, and Oceania [25]. It consisted of the Silk Road Economic Belt, a land route from West China to Eastern Europe, and the 21st Century Maritime Silk Road, a maritime route from East China to the Indian Ocean and the Mediterranean Sea.

BRI emphasized improving transportation infrastructure (e.g., roads, railways, oil pipelines, power grids, and ports), strengthening investment and trade relations, enhancing financial cooperation, providing a platform for national policy dialogues, and deepening social and cultural exchanges [26]. This mega project aimed to cover about 65 percent of the world’s population, about one-third of the world’s GDP, and about a quarter of all the goods and services of the world trade [27].

With growth slowing down, some of China’s manufacturing industries have encountered an overcapacity issue, which BRI could resolve by opening new export possibilities [28]. FDI in BRI member countries would open doors for Chinese companies to enter new international markets, serving the Go Global Policy of China, which aimed to build 50 globally competitive Chinese multinationals [29]. At the same time, BRI would also enable China to access alternative energy and raw material sources, thus safeguarding its national energy and economic security [30]. Furthermore, BRI would increase the usage of the Yuan, the Chinese currency, in BRI member countries, strengthening the currency’s position in international markets [31]. It would also contribute to the economic development of China’s less-developed western regions by connecting them to world markets [32].

BRI would also impact other countries. According to a study by the World Bank, by 2030 BRI could increase global real income by 0.7%, lifting 8.7 million people from extreme poverty and 34 million from moderate poverty [33]. Out of BRI’s total gains, China would capture 36%, BRI member countries altogether 48%, and non-BRI countries 16% [34].

In these respects, BRI was a political initiative for developing global collaboration, simultaneously addressing China’s structural economic issues and improving economic and social conditions around the world [35]. Hence, BRI aimed to create shared value [36]. It was also a means for China to extend its global political influence [37].

Since its launch, significant investments have been made in infrastructure development, and these investments have been financed through loans from China to BRI member countries via the Asian Infrastructure Investment Bank [38]. Infrastructure development projects have been undertaken mostly by Chinese SOEs at strategic positions along the Silk Road. Examples of these projects include among others the Standard Gauge Railway from Mombasa to Nairobi in Kenya, the Karot hydropower station and the Karachi-Lahore highway in Pakistan, the Ya-Wan high-speed rail from Jakarta to Bandung in Indonesia, the Tehran-Mashhad high-speed rail in Iran, and the Sheila GanJie power station in Bangladesh [39].

Some of the BRI projects have been implemented successfully. One good example is the construction of the Pelješac Bridge in Croatia, connecting the Dubrovnik-Neretva County with mainland Croatia bypassing the Neum Corridor. Constructed by China Road and Bridge Corporation, this first BRI project in the European Union created economic value for the company, social value for Croatia, and political value for both China and Croatia [40].

Some projects, on the other hand, were not that successful. An example is the debt default issue in Sri Lanka. Sri Lanka was one of the first countries to join BRI, and it undertook significant infrastructure development projects with loans from China including the Hambantota Port, the Mattala International Airport, the Colombo-Katunayake Expressway, the Norochcholai Coal Power Plant, the Moragahakanda Multipurpose Development Project, the Matara-Kataragama Railway Line, and the Colombo International Financial City [41]. In 2022, Sri Lanka was in pre-emptive debt default, and as a result, the government of Sri Lanka needed to give control of its port to China after failing to pay back its loans. The case of Sri Lanka raised the question of whether BRI was a debt trap for some developing countries [42]. Malaysia, as a second example, canceled the 20 billion USD East Coast Rail Link project and two gas pipeline projects worth 2.3 billion USD, arguing that the country could not afford those BRI projects [43].

Challenges ahead and open questions

It is yet open whether BRI will deliver its promises and revitalize China’s slowing economic growth. There are challenges to overcome to realize the benefits of this mega project. The first challenge is the very low sovereign credit rating of some of the BRI member countries, such as Sri Lanka. The second challenge is the lack of stability and resulting uncertainty caused by wars in Ukraine and the Middle East. The third challenge is the possibility of increasing protectionism and a trade war, i.e., further rising tariffs and customs duties in the United States against imports from China during the forthcoming presidency of Donald Trump after January 2025. The fourth challenge is the risk of further disruption of global value chains by pandemics such as COVID-19. Finally, the fifth challenge is China’s internal challenges of slowing economic growth, decoupled with increasing debt and shrinking workforce [44]. The real-estate crisis in China in early 2024 following the liquidation order of the Evergrande Group, the world’s most valuable real estate company in 2018, has become a symbol of the country’s economic challenges [45].

In light of all these challenges, what are the chances that BRI will succeed and deliver its targeted economic, social, and political benefits? What should the government of China and governments of BRI member countries do to ensure the smooth implementation of BRI projects? What other initiatives could China undertake to improve its competitiveness and revitalize its slowing economic growth?

Exhibits

Exhibit 1. China’s GDP per capita 2012-2023 (in USD)

Exhibit 2. Map of BRI

Exhibit 3. China’s export of goods from 2013 to 2023 (in billion USD)

Exhibit 4. China’s import of goods from 2013 to 2023 (in billion USD)

Exhibit 5. China’s inward FDI from 2010 to 2023 (in billion USD)

Exhibit 6. China’s outward FDI from 2010 to 2023 (in billion USD)

Exhibit 7. China’s competitiveness overview 2018

Endnotes

[1] World Bank Group (n.d.). The World Bank in China. https://www.worldbank.org/en/country/china/overview

[2] CEIC (n.d.). China. https://www.ceicdata.com/en/country/china

[3] Morrison, W. M. (2019). China’s economic rise: History, trends, challenges, and implications for the United States. Congressional Research Service.

[4] Ghosh, I. (2019). The People’s Republic of China: 70 years of economic history. Visual Capitalist. https://www.visualcapitalist.com/china-economic-growth-history/

[5] Morrison, W. M. (2019). China’s economic rise: History, trends, challenges, and implications for the United States. Congressional Research Service.

[6] Ibid.

[7] Ghosh, I. (2019). The People’s Republic of China: 70 years of economic history. Visual Capitalist. https://www.visualcapitalist.com/china-economic-growth-history/

[8] Yu, H. (2017). Motivation behind China’s “One Belt, One Road” initiatives and establishment of the Asian Infrastructure Investment Bank. Journal of Contemporary China, 26(105), 353-368.

[9] Deloitte (n.d.). Analysis: 2016 global manufacturing competitiveness index. https://www2.deloitte.com/us/en/pages/manufacturing/articles/global-manufacturing-competitiveness-index/.html

[10] Morrison, W. M. (2019). China’s economic rise: History, trends, challenges, and implications for the United States. Congressional Research Service.

[11] Caixin Global (2018). Huawei now world’s largest telecom equipment-maker. https://www.caixinglobal.com/2018-03-19/huawei-now-worlds-largest-telecom-equipment-maker-101223256.html#:~:text=Huawei%20has%20surpassed%20Sweden%E2%80%99s%20Ericsson%20AB%20to%20become,use%20of%20products%20from%20the%20Chinese%20tech%20giant

[12] CNN Business (2020). Samsung slump makes Huawei the world’s biggest smartphone brand for the first time, report says. https://edition.cnn.com/2020/07/30/tech/huawei-samsung-q2-hnk-intl/index.html

[13] OICA (n.d.). 2023 production statistics. https://www.oica.net/category/production-statistics/2023-statistics/

[14] Morrison, W. M. (2019). China’s economic rise: History, trends, challenges, and implications for the United States. Congressional Research Service.

[15] Sawe, B. E. (2017). Which are the biggest industries in China? WorldAtlas. https://www.worldatlas.com/articles/which-are-the-biggest-industries-in-china.html

[16] Verisk Maplecroft (2021). China’s resource security redrawing geopolitical map – Political risk outlook 2021. https://www.maplecroft.com/insights/analysis/chinas-resource-security-redrawing-the-geopolitical-map/#report_form_container

[17] Statista (2024a). Export of goods from China 2013-2023. https://www.statista.com/statistics/263661/export-of-goods-from-china/

[18] Statista (2024b). Annual growth rate of imported goods in China 2013-2023. https://www.statista.com/statistics/257012/growth-of-goods-imported-into-china/

[19] Statista (2024c). Industries & markets. Foreign direct investment (FDI) into China. https://www.statista.com/study/108194/foreign-direct-investment-fdi-into-china/

[20] Akpinar, M., & Qi, L. (2020). A comparison of the innovation ecosystems in China and Finland using the triple helix model. Finnish Business Review, 7, 13-26.

[21] Ibid.

[22] WIPO (2024). Top science and technology clusters in China. https://www.wipo.int/gii-ranking/en/china/section/science-tech-clusters

[23] Ibid.

[24] Schwab, K. (2018). The global competitiveness report 2018. World Economic Forum.http://www3.weforum.org/docs/GCR2018/05FullReport/TheGlobalCompetitivenessReport2018.pdf

[25] Business Insider (2019). The US is scrambling to invest more in Asia to counter China’s ‘Belt and Road’ mega-project. Here’s what China’s plan to connect the world through infrastructure is like. https://nordic.businessinsider.com/what-is-belt-and-road-china-infrastructure-project-2018-1

[26] Ma, S. (2022). Growth effects of economic integration: New evidence from the Belt and Road Initiative. Economic Analysis and Policy, 73, 753-767.

[27] McKinsey & Company (2016). China’s One Belt, One Road: Will it reshape global trade? https://www.mckinsey.com/featured-insights/china/chinas-one-belt-one-road-will-it-reshape-global-trade

[28] Yu, H. (2016). Motivation behind China’s “One Belt One Road” initiatives and establishment of the Asian Infrastructure Investment Bank. Journal of Contemporary China, 26, 105, 353-368.

[29] Voss, H. (2011). The determinants of Chinese outward direct investment. Edward Elgar Publishing.

[30] Yu, H. (2016). Motivation behind China’s “One Belt One Road” initiatives and establishment of the Asian Infrastructure Investment Bank. Journal of Contemporary China, 26, 105, 353-368.

[31] Ibid.

[32] Ibid.

[33] Maliszewska, M., & van der Mensbrugghe, D. (2019). The Belt and Road Initiative: Economic, poverty and environmental impacts. Policy Research Working Paper 8814. World Bank Group.

[34] Ibid.

[35] Lewin, A. Y., & Witt, M. A. (2022). China’s Belt and Road Initiative and International Business: The overlooked centrality of politics. Journal of International Business Policy, 5, 266-275.

[36] Akpinar, M., & McCaleb, A. (2024). An institutional framework for analysing the influence of international business policy on creating shared value. In P. Gugler & A. T. Lehmann (Eds.) Handbook on International Business Policy, 211-225. Edward Elgar Publishing Ltd.

[37] Yu, H. (2016). Motivation behind China’s “One Belt One Road” initiatives and establishment of the Asian Infrastructure Investment Bank. Journal of Contemporary China, 26, 105, 353-368.

[38] Li, J., Van Assche, A., Fu, X., Li, L., & Qian, G. (2022). The Belt and Road Initiative and international business policy: A kaleidoscopic perspective. Journal of International Business Policy, 5, 135-151.

[39] Top China Travel (n.d.). One Belt One Road initiative. https://www.topchinatravel.com/silk-road/one-belt-one-road.htm

[40] Akpinar, M., & McCaleb, A. (2024). An institutional framework for analysing the influence of international business policy on creating shared value. In P. Gugler & A. T. Lehmann (Eds.) Handbook on International Business Policy, 211-225. Edward Elgar Publishing Ltd.

[41] Global Connectivities (2024). 12 years into the Belt and Road – what has Sri Lanka achieved so far? https://globalconnectivities.com/2024/03/12-years-bri-sri-lanka/

[42] Foreign Policy (2021). Chinese Belt and Road investment isn’t all bad – or good. As Sri Lanka shows, when it comes to Chinese debt, small states have agency and great powers have responsibilities. https://foreignpolicy.com/2021/03/02/sri-lanka-china-bri-investment-debt-trap/

[43] South China Morning Post (2018). China’s ‘Belt and Road Initiative’: after five years, is the bloom off the rose? https://www.scmp.com/news/china/diplomacy/article/2166727/chinas-belt-and-road-initiative-after-five-years-bloom-rose

[44] Npr (2024). Here’s what to know about the collapse of China’s Evergrande property developer. https://www.npr.org/2024/01/30/1227554424/evergrande-china-real-estate-economy-property-collapse

[45] Ibid.